Ready to start a new life in South Korea? You’ll want to know how to open a bank account in Korea to make your time as a foreigner in Korea a lot easier in the months and years ahead.

Not to worry, we’ll map out everything you need for smooth sailing with your new bank account.

Let’s get started!

Contents

- 1 Opening an Account in a Korean Bank

- 2 Do Korean Banks Have English speakers?

- 3 What to Prepare Before Your Trip to the Bank

- 4 Application Process

- 5 Important Things Related to Your Korean Bank Account

- 6 International Transfers to Another Bank

- 7 Using Your ATM Card While Traveling Abroad

- 8 International Currency and Foreign Exchange Rates

- 9 Approvals and Rejections

- 10 List of South Korean Banks

Opening an Account in a Korean Bank

In this article, we’ll try to explain the process of opening a bank account in South Korea as easily as possible. An important thing to note is that Korea is a rapidly changing country.

The bank account rules and requirements are constantly being updated, so while you can use this info as a general guide, make sure you know what you need before applying. Call the bank first before you head in to open an account to find out specifically what you need.

Why should you open a bank account in Korea?

There are several reasons why ex-pats or foreigners would want to open a bank account in South Korea. You might consider opening a Korean bank account if:

- You’re thinking about moving to Korea

- You’ll be moving to Korea soon

- You’re planning to study Korean at a school and are only here temporarily

- You want to get payments from an employer overseas

- You’ll be getting a salary in Korea

- You want to get a Korean credit card

- You’ll be traveling in Korea for several months.

Do Korean Banks Have English speakers?

Generally, yes. Most financial institutions and banks have at least one English-speaking staff, especially at large branches in major cities like Seoul or Busan. So, you should be able to learn about the bank account and the bank’s services through them.

But if you’re in a remote area or far from a large branch, there is a chance that the only English-speaking staff at your local bank works only on certain days or, worst case, no one speaks English fluently. However, all Koreans will have at least a limited English ability.

If that’s the case, it’s best to bring a Korean speaker with you or have one on the phone to help when you go to open a bank account. If you don’t know anyone who can help, you can also try the Dasan Hotline by dialing 120 or the Korea Tourism hotline 1330. They may be able to help translate the most important parts of your process.

If you’re motivated to try applying on your own, we have some Korean bank phrases that will help you to complete your application. You might want to bring a Korean dictionary with you as well. Here are the best ones to use.

For a more structured Korean course, you can also check out the 90 Day Korean Membership Program. You’ll be able to have 3-minute conversations in just 90 days!

What to Prepare Before Your Trip to the Bank

Here are some key documents that all the banks in South Korea require for opening a bank account. Some documents can vary between banks. Included below are the Korean words and their romanized versions to help you become easily familiar with these key requirements.

Passport/Visa

(여권/비자 | yeogwon/bija)

You should already have a passport, including your Visa if you’re in South Korea for a job or to study. Just don’t forget to bring it or you’ll have a wasted trip! They’ll usually want your passport with another photo ID (more on that below).

Certificate of Employment

(재직증명서 | jaejikjeungmyeongseo)

This is a relatively new requirement at some large banks, and don’t be surprised if they ask you for it. This could also be some kind of proof of work, like a signed contract with your employer.

Remember to bring this if you’re in South Korea to work. If you’re a student or on an education visa, then your school should have an agreement with some bank and be able to provide you with assistance or the information you need to open a bank account.

Alien Registration Card

(ARC | 외국인 등록 카드 | oegugin deungnok kadeu)

Having an ARC will give you the most options for functionality for your bank account. For example, it can allow you to do online banking, get an ATM card, and transfer money overseas.

It can sometimes take up to a month to get your ARC, and banks are aware of this. If you don’t have an ARC card or are waiting for yours to be processed, most banks will allow you to open a bank account with a passport. However, your account will have limited services, or you’ll have to use it in person with a bank teller until you get it.

If you’re in South Korea on a short-term education visa, you may not be eligible for an ARC.

If you don’t have an ARC, you’ll have to accept limited services at your bank or reconsider if you actually need a bank account.

Korean Phone Number

(한국내 전화번호 | hangungnae jeonhwabeonho)

Your Korean phone number will be used by the bank to call you about your bank account if need be. They generally won’t accept an international number. In any case, you’ll want to give them a number that they can actually reach you at in case there’s a problem with your account.

If you don’t have a phone yet, you can use a friend’s number and then change it at the bank later.

Missing Something?

You can occasionally find bank branches that will allow you to open a bank account without all of these documents, but the account may have fewer services, like no ATM card, for example.

The closer you can meet the bank’s requirements, the more services your bank account will have access to.

And, of course, be sure to try to make a good first impression when submitting your application. That can impact whether you’re approved for a bank account.

Application Process

With your documents in hand, all you then need to do is go to the bank! Try to go early because banks close in the early afternoon and can have quite a few people in some places.

When You Arrive

You don’t have to do anything special at this point, when you go in, someone asks what you’re there for, and you can tell them in English that you want to open a bank account. They’ll direct you to the correct counter or give you a number to wait for your turn.

After filling out the forms they give you with your real name, address, and number, it’s just a matter of working out some of the finer details of the services you need. For more on that, read below!

After the Paperwork is Finished

Once your application is complete, most banks will be able to give you a bank card you can start using immediately. You’ll also receive a bank book and an ATM card if you asked for one. It’s a very streamlined experience.

Keep your bank book in a safe place since you may be asked for it sometimes for official purposes.

Your bank book is as important as your bank card, so if you lose it, then you should report it to your bank immediately!

It’s good to build the habit of updating your bank book at least every month, so you’re aware of your bank account balances and where your bank book is.

Here are some of the more specific details you may need to know about your account and the services you can get with it. If you have a more specific question, then just let us know in the comments, and we’ll do our best to find the answer for you!

Bank Account Types

As a general-purpose bank account, most foreigners will opt for a regular account. Keep in mind that the interest gained in your account is extremely low. If long-term savings are on your mind, then you should specify to the bank staff that you would like to open a savings account.

Note: Time affects the interest rates! The longer the term you’ll keep money in your bank account, the better the interest rate.

Online Banking

All major banks offer internet banking, and the largest have options in English (and several other languages, too!). However, the menus are often limited and will only be good for most usual transactions. Some may also not have as many services in English as they do in Korean. But its benefits make it worth having.

If the bank staff doesn’t suggest internet banking, then you should ask.

Passwords

They’ll get you set up with passwords for your online banking, and you should expect to be prompted to change these as a requirement every so often. This is just a bonus security measure for your bank account.

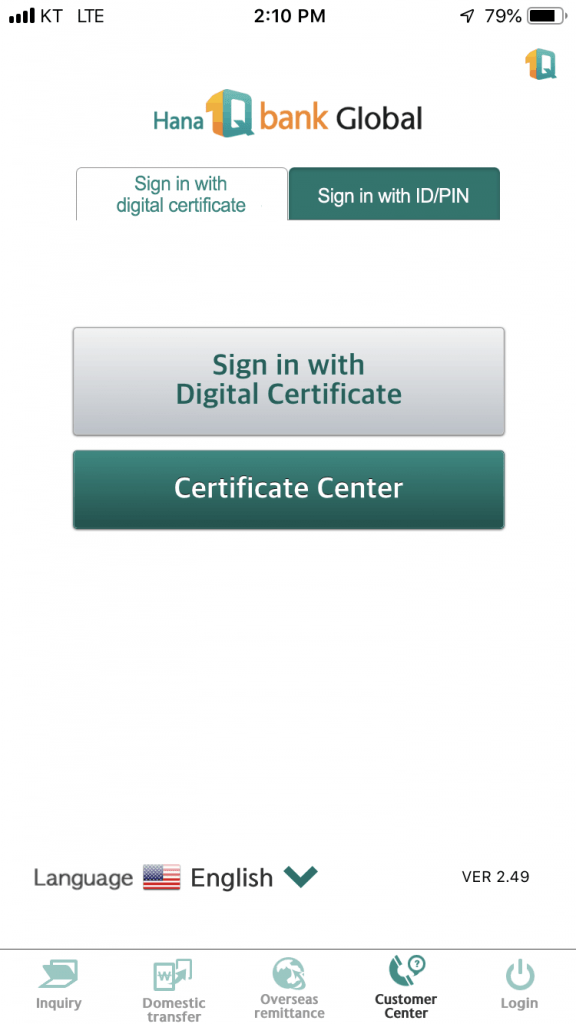

Digital Certificate

You’ll need a digital certificate to do online transfers, so make sure you get one when creating your bank account. This is a digital file that identifies you so you can send money from your account. It’s an added layer of security to make sure nobody is trying to make you part ways with your hard-earned cash.

You can save this file to your computer, a USB, or your smartphone, so you always have it when you travel. Just don’t lose it, and make sure it doesn’t fall into the wrong hands!

If you lose or misplace your digital certificate, call your bank and report it missing, just like if you lost your bank card or bank book.

Smartphone Applications

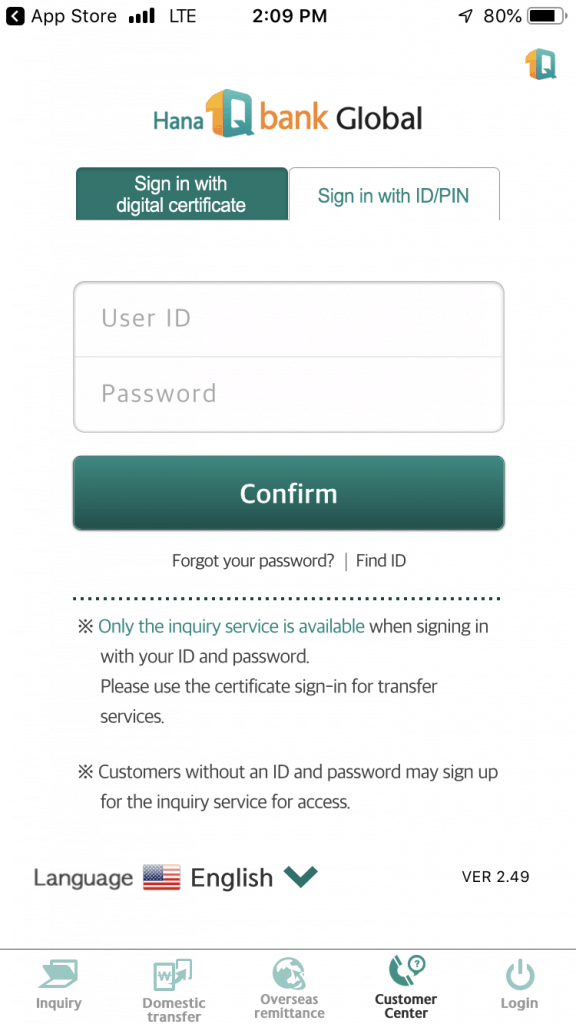

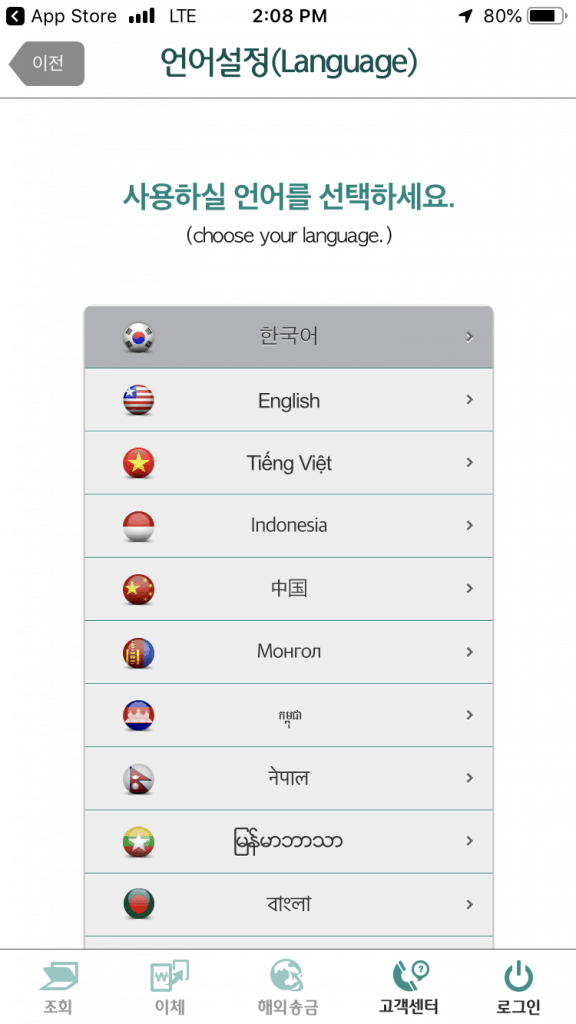

Most banks now have apps in English and Korean, but again the services in English may be limited.

|

|

Security

The number of hoops that banks require you to jump through, especially if you opt for online banking, can be a hassle. Just think of it as benefitting from a personal security service keeping you safe and protecting your hard-earned money.

There are a lot of con artists in Korea and abroad that will try to trick you into revealing your secure bank information, so remember to be safe and careful!

International Transfers to Another Bank

When you open a bank account in South Korea, make sure to ask about choosing a “Foreign Designated Bank.” This is extremely important!

Foreign Designated Bank

If you will be transferring money from your bank account or using your ATM card services outside of South Korea, you will need to have one bank set up as your foreign-designated bank. If not, you won’t be able to transfer money to other countries. Or even worse, you may find yourself traveling in a foreign country with no way to access your cash in South Korea.

You cannot have two foreign designated banks, but it’s easy to change in person at your local branch.

Your bank account will have limits on the cash amount you can transfer per day, per month, or based on your salary, so you should find this out from the bank. You should also find out the bank’s exchange rate for the currency you’ll be using and how this factors into your limits. It’s often not as good as the market rate but can be close depending on the bank and account.

Banking and ATM Hours

Most banks are open from 9 am – 4 pm. However, different bank services may operate at different hours. Some branches stay open later or are open on weekends, and all banks have ATMs. However, you might be surprised that many bank ATMs have hours of banking operations. Some are quite limited, too!

Large banks usually have ATMs that are open until midnight, and some have 24-hour ATMs so you can access your bank account when it’s convenient for you. However, often, they lock the doors after a certain time and require your ATM card to open them.

There are always plenty of ATMs throughout South Korea you can use.

If you’re not using your bank’s ATM, then be prepared to pay a small fee or even use your bank’s ATM outside of business hours.

Using Your ATM Card While Traveling Abroad

If you’re using your ATM card from another country, look for “Global ATM” signs to withdraw your cash from your international bank account. It’s usually not a problem.

International Currency and Foreign Exchange Rates

Dealing with foreign currency can be a bit tricky. Try to be familiar with the exchange rate your bank uses, it’s usually more favorable than the rate you’d get at currency exchange counters, but this isn’t always the case. It’s usually not as good as the market rate, but you might be pleasantly surprised.

Charges & Fees

Most bank accounts don’t charge a service fee and don’t require a minimum balance. You may have a small fee to get your ATM card and will have to pay a transaction fee if you transfer your funds abroad.

Basically, the more labor-intensive the service is for the bank, the more you’ll pay. Bank teller transactions will be the most expensive, followed by ATMs. Internet banking has the lowest fees. You can also expect typical ATM fees for ATMs that don’t belong to your bank or when you travel.

Some ATMs may have a fee for depositing money, though, so be aware of this. There may also be a fee imposed by your bank if you’re exchanging currency.

Approvals and Rejections

South Korea has become a very cosmopolitan country, and almost all banks now allow foreigners to open accounts. 99% of the time, people will be able to open a bank account with no problem, provided they have all the right paperwork.

With that said, some branches may have had bad experiences with foreigners and might have policies that limit the services to your account or require a waiting period of a few months. At worst, your application will be rejected.

Don’t be discouraged if this happens. There are plenty of bank options to choose from, and one of them will allow you to open a bank account if you meet their requirements. And you may even be able to open an account at a different branch of the same bank.

List of South Korean Banks

The big three that ex-pats and foreigners in Korea typically use are KEB Hana Bank, Woori Bank, and Shinhan Bank.

Give them a ring and see if they’re worth a visit! You should also check a map of your area so you know what local banks would be most convenient for you to use.

These are some of the most expat-friendly banks you can find in South Korea, and you shouldn’t have an issue opening a bank account with them.

KEB Hana Bank

Main: https://www.kebhana.com/

English: https://www.kebhana.com/easyone_index_en.html

Korea: 02-1544-3000 x8,9

Overseas: +82-1544-3000 x8,9

Notes: Foreigners love their experience with this KEB Hana Bank. A little light on the ATMs but good English support and services. Great place to open a bank account.

Woori Bank

Main: https://www.wooribank.com/

English: http://eng.wooribank.com

Korea: 02-1599-2288

Overseas: +82-1599-2288

Notes: Woori Bank has ATMs everywhere. Online banking is very good as well. One of the most popular spots to open a bank account.

Shinhan Bank

Main: http://www.shinhan.com

English: http://www.shinhan.com/en/

Korea: 02-1577-8380

Overseas: +82-1577-8380

Notes: Shinhan Bank has lots of branches that cater to foreigners with a robust selection of services. A solid choice for your new bank account.

Do you have any questions about opening a Korean bank account? What do you think is the best bank for foreigners? Let us know in the comments below!

Is it true that Korean banks have both company name and owner name as a bank account name?

Hi, Ainel! It’s true if the account is a business account. ^^

Hi. I lost my keb hana easy one passbook when i go back home in the Philippines. It’s been 2yrs since i open an easy one account in keb hana and i forgot my account number. Can i open a new easy one account when i go back to korea?

Hi, Jnl! I think it’s better to inquire the bank about this! (https://www.kebhana.com/easyone_index_en.html)

Hello, may I know if I want to open a bank account but I dont have arc, i still can have the bank book and atm card but the function is limited right? I am travelling to seoul from my home country back and forth for personal work, so i need a korean bank account for it but dont have arc. Is it possible?

Hi, Kin! I believe you can still open a bank account, but you should ask each bank about the details and the files you need to prepare in advance! ^^

Hi,

So the only options I have if I want to purchase things online are credit cards and bank transfers (online banking) correct? Let’s say I can get the ARC and apply for online banking, what happens when I return the ARC upon leaving korea? Do I still have access to my online banking and credit card? Thank you!

Hi, Angeline! I believe you’ll still be able to use your online banking, but you should ask the bank’s customer service to make sure. ^^

Hi

I would like to ask if I as a non-resident want to open a bank account in a Korean bank in order to transfer my money there from my home country, usually how much money can be transferred to my Korean bank account?

I would like to purchase property (real estate/apartment) in Seoul, as a non-resident foreigner, and first I would need a Korean bank account. Can I transfer and also convert my money which is in Euro to Korean Won in these banks? I am talking about millions of Euros which I would like to convert/change to Koresn Won.

Thank you!

Hi Nicole! It really depends on the bank, you should try calling some of the bank branches and ask for transfer limits. ^^